SuperFi Finance (t/a SuperFi) secures £780k Pre-Seed investment led by Ascension

The pre-seed round was led by Ascension, and includes a significant grant from the Greater London Authority

The London-based fintech startup is designed to help 18m UK adults struggling to pay their monthly bills, and could save them more than £130m over the next five years

The founders bring banking (NatWest) and startup (Groupon, Zava) experience to deliver ambitious growth

LONDON, UK – 28 JULY 2023: SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis. The round was led by UK seed fund Ascension and its impact fund, Fair By Design, and includes Force Over Mass, and a number of other prominent investors.

The London-based fintech startup is revolutionising debt management by providing users with an overview of their debts, analysing their financial and personal circumstances, and then giving users access to the most suitable debt prevention tools and services.

To understand the scale of the UK’s debt management challenge, 18 million British adults are struggling to pay their monthly bills and credit commitments, according to research from StepChange. These individuals aren’t yet in arrears, so they are not eligible for formal debt solutions. Collectively, they hold more than £70bn in unsecured debts.

Tom Barltrop, co-founder of SuperFi, said, “We believe that debt management should be proactive, not reactive. Our goal is to help millions of people struggling to pay their bills and credit commitments better manage their debt before it becomes a crisis. In doing so, we believe we can help British people during the cost of living crisis – saving businesses and society billions associated with problem debt.”

SuperFi’s platform, which helps users stay on top of their monthly bills and credit commitments and out of problem debt, has the potential to save users £130m in debt repayment costs by 2028.

The company has also received grant funding from the Greater London Authority as part of the Mayor of London’s Challenge LDN scheme to combat poverty. The funding allows SuperFi to prototype and test its platform with Councils and Housing Associations across London.

The funding will be used to support authorisation via the FCA’s innovation sandbox and launch partnerships with London boroughs. These initiatives will allow SuperFi to test and refine the platform; bringing debt prevention tools to Londoners for the first time, before it is rolled out across the UK.

Emma Steele, Partner at Ascension, added, “We are thrilled to be supporting SuperFi in its mission to tackle the UK’s growing debt crisis and improve financial well-being for individuals and communities. With over £1.6 trillion in personal debt in the UK alone, the scale of the problem is massive, and SuperFi’s innovative platform is uniquely positioned to address it through a partner based business model that remains on the consumers’ side as the business scales. We look forward to helping the team achieve their vision.”

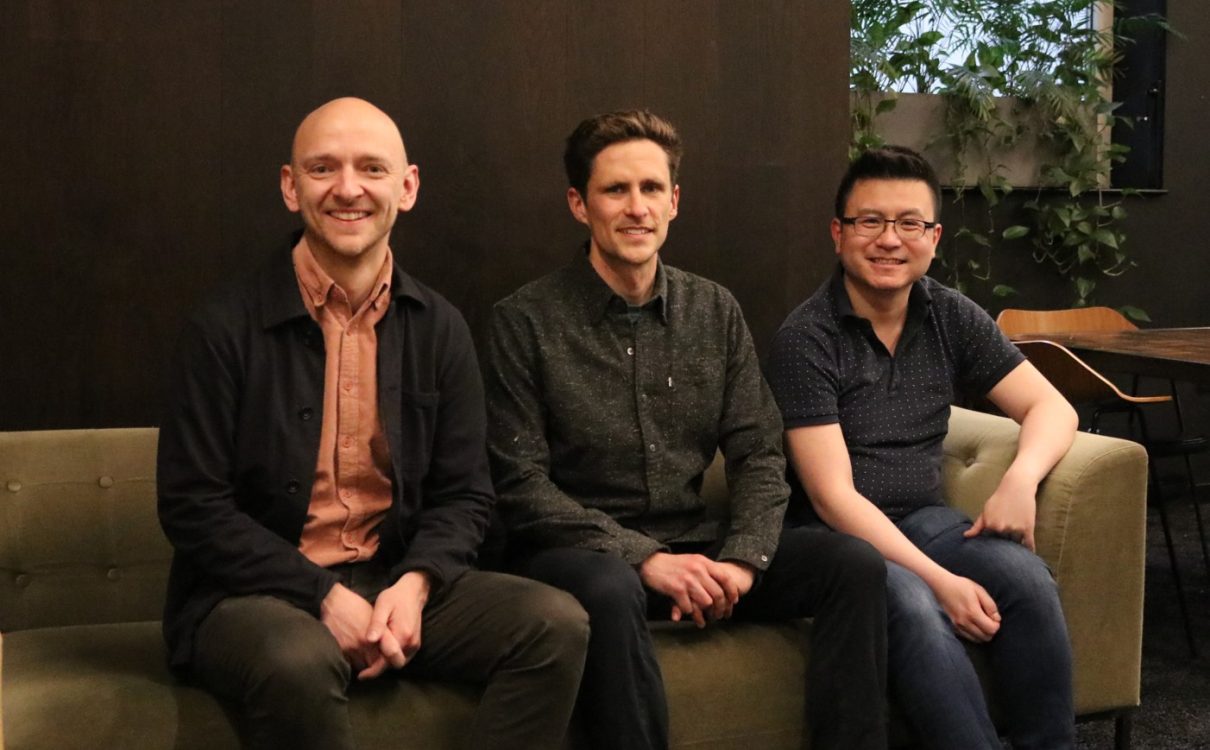

The founders of SuperFi, met during an Antler residency in London, and bring together a wealth of expertise from banking and tech startup environments. CEO Tom Barltrop specialises in delivering rapid growth for startups. He was an early employee at Groupon UK and recently achieved triple digit growth as Head of UK for European healthtech startup, Zava.

CTO Nick Spiller has consulted for numerous high-growth fintechs and held key roles at Natwest and Xapo with a focus on building products for the financially vulnerable.

SuperFi’s pre-seed funding round was facilitated by Floww, a newly launched fundraising platform, where it surpassed its funding goal in just over 24 hours. SuperFi is the first startup to manage its fundraise on the platform.

Martijn De Wever, CEO of Floww, added, “SuperFi’s purpose driven vision and ambitious team inspired a high level of investor excitement on our platform, which led to a very swift round closure. As the first company to use Floww for fundraising, we were all delighted to see them hit their target and oversubscribe in one day.”

SuperFi has also previously received backing from Antler, the most active early-stage investor in Europe.

Ollie Purdue, Partner at Antler, comments, “SuperFi represents a new generation of fintech startups building solutions designed to address the significant challenges facing consumers during the cost of living crisis. SuperFi will undoubtedly have a positive impact on society in the UK. We are delighted to have backed the SuperFi team from day zero and this funding round is testament to their impressive traction and long-term growth potential.”

SuperFi will be available on iOS and Android devices and is due to launch to the public towards the end of 2023.

For more information go to joinsuperfi.com

About SuperFi

18 million people in the UK are struggling to pay their bills but are not yet in arrears – so existing debt solutions are not suitable for them. SuperFi is the first app to analyse people’s financial and personal situations to recommend and provide access to a comprehensive range of solutions to maximise income, reduce missed payments and prevent problem debt.

SuperFi partners with organisations to help them improve outcomes for vulnerable customers whilst also reducing arrears and debt write-offs.

About Ascension

Built by exited tech entrepreneurs, Ascension has invested in 150+ startups since 2015 to establish itself as the most active VC fund in London over the past decade and the UKBAA’s Seed VC of the Year in 2022, solidifying its reputation as the UK’s leading early stage investor. Following its unrivalled exposure to the UK tech and impact ecosystems, Ascension backs the next generation of founders who are leveraging technology to solve society’s biggest problems.

About Fair By Design

The Fair By Design fund, managed by Ascension, was set up to invest in scalable companies tackling the ‘poverty premium’. People on low incomes pay on average £490 more each year for the same goods and services as people who are better off financially. This is the “Poverty Premium”. The fund backs tech enabled innovations that can scale commercially to the pace & scale of typical venture backed business whilst tackling both the drivers and effect of the poverty premium.