DebtStream Solutions secures £1.1 million Seed investment led by Ascension

DebtStream raises £1.1m to revolutionise the collections experience

DebtStream has raised £1.1m led by Ascension’s Fair By Design Fund, with participation from Fin Venture Capital, a US fund focused on B2B SaaS. A number of angels also participated in the round including Chris Adelsbach (founder of Outrun Ventures and John McAndrew (former CEO of Callcredit, now TransUnion).

Another investor, Ken Stannard (former CEO Cabot and European President of Encore), has also joined the board as chairperson. CEO, Gareth Bailey, said:

“We’re thrilled to have Ken join our board, his depth of experience and proven record of delivering strong growth across financial sector companies make him an excellent addition as we build our global delivery capability”

Ken Stannard said

“Creditors are waking up to a massive online collections opportunity and Debtstream have the market leading solution. I am very excited to both invest and join the board to help the team scale to meet pent-up demand”

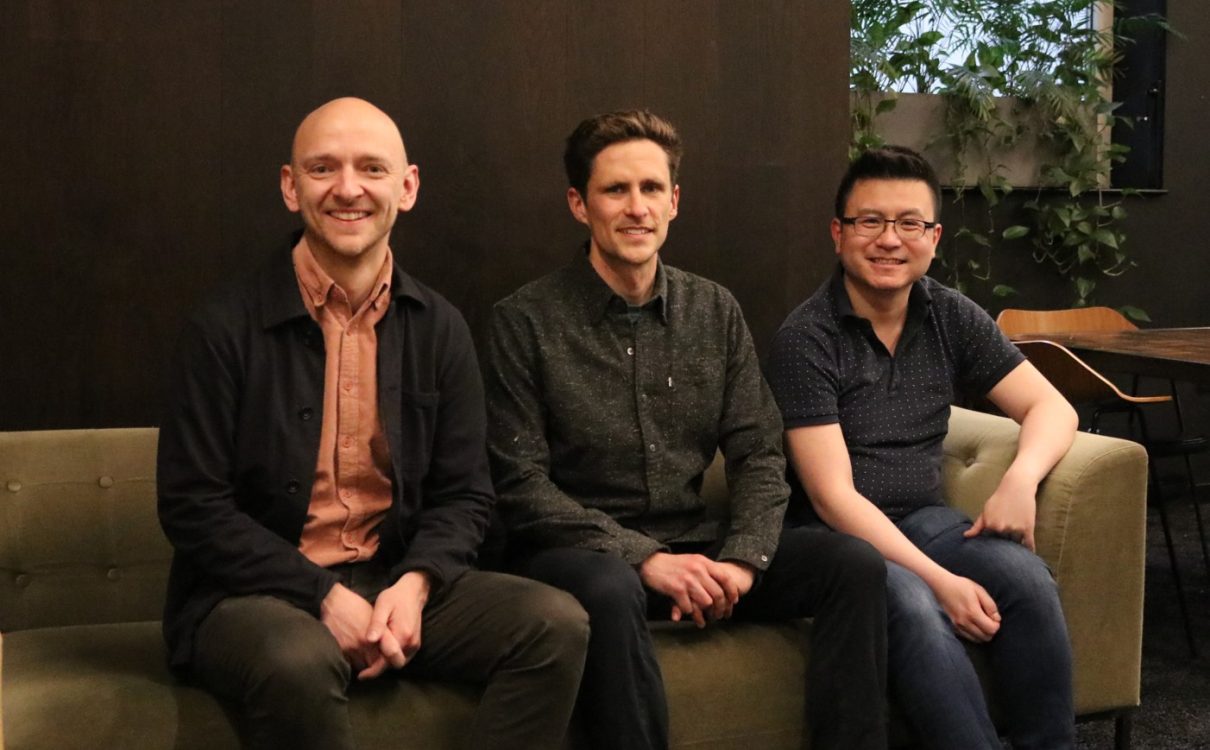

The DebtStream founders, Gareth Bailey, Martin O’Donnell and Leo De Freitas have built digital channels for some of the world’s leading Collections specialists. They wanted to take it further, faster so founded DebtStream and created the market leading platform to support customers who fall into arrears.

The experience of the founding team has shown that customers in financial difficulty are often reluctant to engage through traditional call centre channels, often due to embarrassment and the stress they feel in confronting their situation directly.

“Talking from personal experience, I’ve seen a family member with a relatively small debt, bombarded with letters, phone calls and doorstep visits, causing them to bury their head in the sand and ignore the situation. Had there been a digital safe space for them to use, in their own time, without this pressure, they would have addressed their arrears and got back on their feet sooner”.

CPO, Martin O’Donnell:

“today, the vast majority of customers’ experiences are disjointed when they fall behind with payments on loans, credit cards or utility bills. Over 80% of the UK population are now using online banking to manage their day to day finances and it’s shocking to still find that less than 20% of arrears management departments offer any digital self service to their customers. There is a clear gap in customer experience that needs to be closed!”

For customers in financial difficulty, who are often anxious and worried, it is crucial to make interactions as clear and easy as possible and on their terms. DebtStream’s product delivers an ease of customer engagement similar to the best online products that customers deal with in their day-to-day lives.

DebtStream aims to reimagine the debt collections experience for customers when they fall into arrears. They will work with their clients to help ensure they have the right digital options available for their customers.

Gareth Bailey, CEO:

“We will further accelerate our growth with hires in engineering and client set-up. We will also work towards a ‘plug and play’ model where our clients can be up and running with our platform in a matter of days.”

“Due to the lack of innovation in the debt collection sector, borrowers are more disconnected than ever with debt collection agencies and lenders. Debtstream aims to improve the collections process by fostering honesty and trust between the borrower and debt collector through personalised repayment plans. The Debtstream team is highly driven and focused on improving the visibility of the collections process to benefit both borrowers and debt collectors. We’re excited to be leading this investment round from our Fair By Design Fund which aims to tackle the Poverty Premium.” Sam Marchant, Ascension