SamsonVTI UK secures £3.8 million Seed investment led by Par Equity

SamsonVT secures $5.1 million in seed round funding to enable rapid growth

The investment, led by Par Equity with Blumberg Capital, will fund product development and expansion into new markets

Manchester, U.K. — 27 January, 2022 — Manchester-based technology start-up, SamsonVT, today announced that it has received $5.1M in seed funding with investment led by Par Equity, with participation from US-based Blumberg Capital.

SamsonVT has developed Industry 4.0 solutions that are transforming product maintenance and after sales, a $400B market. SamsonCORE, for example, is changing the way maintenance engineers work by replacing paper-based technical manuals and parts catalogues with 3D models. Hosted on an interactive digital platform, SamsonCORE can also connect engineers with the wider supply chain to improve order fulfilment rates.

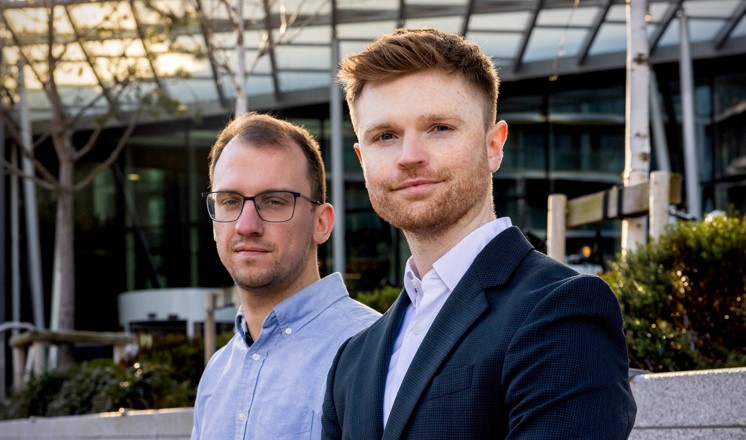

The company was co-founded by Sam Burgess and Ed Brunyee in 2017 after they saw an opportunity for emerging technologies, including immersive 3D modelling and machine learning, to solve the challenges OEMs encounter when managing the life cycle of equipment on a global scale.

Sam, a former team leader in the Royal Engineers, and Ed, a corporate finance advisor, both had experience advising and supporting multi-national organisations, and realised there was the potential to provide critical solutions to the multi-billion dollar after sales market – a market that has traditionally been underserved by the technology sector.

The company has since undergone rapid growth with a fast-expanding client base that includes global businesses Lotus, RS Components and Norton Motorcycles.

The funding will be used to support SamsonVT’s aggressive global growth strategy, which includes plans to develop new and existing products, enhance customer service and scale production as the company expands into new territories.

Advisors at Sand Hill East are supporting SamsonVT through its next phase of growth in sales, marketing and business development, as well as strategically preparing for entry into the US.

Sam Burgess, CEO and co-founder of SamsonVT, said:

‘‘Having the support of Par Equity, Blumberg Capital and Sand Hill East is a powerful endorsement of SamsonVT which demonstrates belief in the company’s potential – we are thrilled to have their backing. There is a huge desire for smart technologies that help OEMs improve customer service, while also allowing them to operate more efficiently and in a more sustainable way. We can help them achieve these goals and this funding will enable us to provide our solutions to more organisations far sooner.’’

Aidan MacMillan, Senior Investment Manager, Par Equity said:

“SamsonVT has the potential to become the go-to platform for the after sales market, an industry that is vast in size, fragmented, and characterised by a lack of innovation. The Covid-19 pandemic has accelerated the move to digital, and Sam, Ed and the team have an ideally placed product geared towards Industry 4.0. We are excited to support their journey in the years ahead.”

“We are excited to partner with Sam, Ed and the entire SamsonVT team including Par Equity and Sand Hill East,” said Stanton Green, Blumberg Capital. “After sales is a $400B global marketplace experiencing a digital evolution and SamsonVT will be at the forefront, helping a growing market make the transition. We look forward to the journey ahead and helping SamsonVT make an impact on Industry 4.0, across the U.S. and globally.”

“We were attracted by SamsonVT’s ability to disrupt and digitise aftermarket servicing and order fulfillment, and wanted to participate and work with them to build out the business and bring their unique capabilities to the Americas market.” said Andy Brown, CEO, Sand Hill East.

– ENDS –

About SamsonVT

SamsonVT was born of frustration with the status quo, where product after sales management is treated as an afterthought. SamsonCORE helps businesses to empower engineers on the ground, by replacing technical manuals and parts catalogues with easy-to-follow 3D models on a digital platform, that is always up-to-date. This ensures maintenance can be carried out as efficiently as possible, saving businesses from costly delays. Simple to update across numerous languages, SamsonCORE also enables better on the job training and upskilling.

About Par Equity

Par Equity is a leading venture capital firm, based in Edinburgh, investing across the North of the UK in innovative B2B technology companies, with high growth potential. Since it was founded in 2008, Par Equity has now invested more than £100m across 66 companies, leveraging a further £210m of capital from third party investors.

About Blumberg Capital

Blumberg Capital is an early-stage venture capital firm that partners with visionary entrepreneurs to build successful technology companies that empower individuals, businesses and society through the innovative use of AI, big data and other transformative technologies. We are passionate about nurturing B2B technology companies from Seed stage through their growth journey, as active board members and hands-on advisors. We were among the first investors in industry leaders including Addepar, Braze, Credorax, DoubleVerify, Fundbox, HootSuite, Katapult, Nutanix, Trulioo and Yotpo. Find us in San Francisco, Tel Aviv, Miami and New York or at blumbergcapital.com.