London-based marketplace Laced, which enables consumers to access the most sought-after, and difficult-to-obtain, sneakers, receives backing from Talis Capital and H&M Group Ventures LONDON. UNITED KINGDOM. 24TH MAY 2023.: Laced, the Read More

Tags :Talis Capital

Bondaval’s technology-enabled MicroBonds provide certainty of cover on receivables to FTSE 100 and S&P 500 multinationals, including Shell and BP LONDON, UK: 15TH DECEMBER: Bondaval, a London-based B2B fintech that gives credit Read More

Investors back Plum Guide with $31m as CEO heralds ‘revenge travel’ boom Extended Series B funding round includes successful $3.5m crowdfunding round backed by hosts, guests, and fans of Plum Guide Investment led by Beringea Read More

Vinehealth raises $5.5m to improve the quality of life and survival of cancer patients The round was led by Talis Capital, with participation from Playfair Capital, Ascension and healthcare heavyweights 3 December 2021, London: Today, Vinehealth announces Read More

Funding round led by Beringea with participation from existing investors Talis Capital, Hearst Ventures and Latitude (LocalGlobe) · ‘Michelin Guide for Homes’ launches crowdfunding round with Crowdcube ·&Read More

REAL ESTATE FINTECH STARTUP – IMMO – SECURES €72 MILLION IN FUNDINGIMMO Investment Technologies has announced a funding round totalling €72 million, with €11.5million in equity from prominent investors Talis Capital, HV Holtzbrinck Ventures, Tom Stafford & Rahul Mehta Read More

April 15, 2019 b Funding round led by signals Venture Capital, with other investors including Talis Capital, Mutschler Ventures, IBB Beteiligungsgesellschaft and prior backer Cavalry Ventures Announcement signals rapid expansion of ground-breaking, end-to-end digital patient care Read More

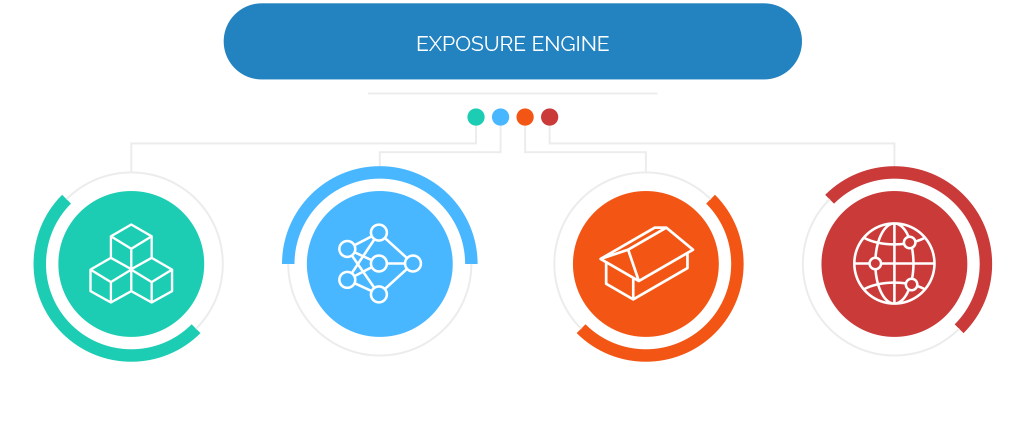

London, 15 April 2019 – Insurdata, the award-winning insurtech firm which specialises in the augmentation of peril-specific exposure and risk data via its Exposure Engine Platform, has today announced that it has secured $3 million from a group Read More

London, 21 March 2019 – The Plum Guide has raised £14m from some of Europe’s leading early-stage investors to support its ambitious rollout to 12 new cities this year. Known as the “Michelin Guide for Homes”, The Plum Read More